How I Crushed My Debt and Found Financial Freedom — A Beginner’s Real Talk

I used to feel trapped — every paycheck went straight to bills, and the debt just kept growing. I didn’t know where to start, and the stress was real. But after trying (and failing) a few methods, I finally found a simple, proven path that actually worked. This is my story — not a perfect one, but an honest one — about how I took control, paid off what I owed, and started building real financial confidence. It wasn’t magic. There were no windfalls, no side hustles that went viral. Just consistent choices, a clear plan, and the courage to face numbers I’d spent years avoiding. If you’re feeling stuck, this is for you.

The Breaking Point: When Debt Felt Like a Life Sentence

There was a moment — not dramatic, not cinematic — when I sat on my kitchen floor, surrounded by paper statements, and realized I couldn’t remember the last time I’d looked at my finances without panic. My credit card balances were climbing, my car loan felt endless, and student debt loomed like a shadow I couldn’t escape. Each month, I paid the minimums, believing that was all I could do. I told myself I was staying afloat. But in truth, I was sinking. The average interest rates on my cards were over 19%, meaning most of what I paid was just covering interest, not the actual debt. I was working hard, but my money wasn’t working for me — it was working against me.

The emotional toll was just as heavy as the financial one. I avoided opening mail. I felt shame when friends talked about vacations or home improvements. I stopped checking my bank account altogether, afraid of what I’d see. That avoidance created a cycle: the less I looked, the worse it got, and the worse it got, the harder it was to face. I wasn’t alone — studies show millions of households live in similar stress, with credit card debt in the U.S. alone exceeding $1 trillion. But knowing others were in the same boat didn’t make my burden lighter. What changed was realizing that staying in denial wasn’t protecting me — it was prolonging the pain.

This breaking point wasn’t sparked by a single event, but by a slow accumulation of small frustrations: declining a dinner invite because I couldn’t afford it, lying awake at 2 a.m. worrying about a late fee, watching my credit score drop despite making payments. I finally admitted that my habits — ignoring budgets, using credit for convenience, treating minimum payments as sufficient — were not temporary fixes. They were the root of the problem. And if I wanted real change, I had to change not just what I did with money, but how I thought about it. The first step wasn’t a payment plan. It was a mindset shift: from helplessness to responsibility, from fear to action.

Facing the Numbers: The First Step Toward Real Control

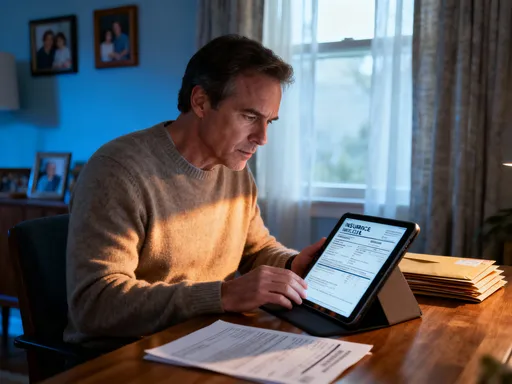

Control begins with clarity. I knew I couldn’t fix what I wouldn’t face, so I scheduled a Sunday afternoon to gather every piece of financial paper I’d been avoiding. Credit card statements, loan documents, medical bills — anything with a balance. I listed each debt on a single spreadsheet: the creditor, the total balance, the interest rate, the minimum payment, and the due date. Seeing it all in one place was overwhelming at first. The total came to over $28,000 — a number that made my stomach drop. But strangely, once it was out of my head and onto the page, it felt less like a monster and more like a problem I could solve.

Awareness is the foundation of financial recovery. Without it, every decision is made in the dark. I learned that ignoring debt doesn’t make it disappear — it only allows interest to grow unchecked. For example, one card with a $5,000 balance at 22% interest would take over 20 years to pay off with minimum payments alone, costing nearly $6,000 in interest. That wasn’t just a number — it was a wake-up call. I wasn’t just delaying freedom; I was paying a massive premium for the privilege of staying in debt.

This step wasn’t about judgment. I didn’t berate myself for past choices. Instead, I treated the exercise like a medical diagnosis: cold, factual, and necessary. Once I had the full picture, I could begin to create a treatment plan. I also checked my credit report to ensure all listed debts were accurate and up to date. Disputing even one error saved me hundreds. The goal wasn’t perfection — it was progress. By the end of that afternoon, I hadn’t paid a single dollar toward my debt, but I had already taken the most important step: I was no longer running from it. I was ready to fight back, with eyes wide open.

Choosing the Right Repayment Strategy: Avalanche vs. Snowball — What Actually Works?

With my debts listed, I faced a critical decision: where to start? I researched two widely recommended methods — the debt avalanche and the debt snowball — and learned that each has strengths, depending on your personality and priorities. The debt avalanche focuses on paying off debts with the highest interest rates first, while making minimum payments on the rest. Mathematically, this is the most efficient path. It minimizes the total interest paid and shortens the repayment timeline. For someone strictly focused on cost and speed, this is the logical choice.

The debt snowball, popularized by financial experts, takes a different approach: pay off the smallest balances first, regardless of interest rate. The idea isn’t mathematical efficiency — it’s psychological momentum. Knocking out a small debt quickly creates a sense of achievement, which fuels motivation to keep going. Research in behavioral economics supports this: small wins rewire the brain to believe progress is possible, making long-term goals feel more attainable.

I knew I needed motivation more than I needed pure efficiency. My confidence was low, and I’d already failed at budgeting twice before. I worried that the avalanche method — while smarter on paper — would feel too slow. The highest-interest debt was also the largest, meaning it would take months before I saw any real progress. So I chose the snowball method. My smallest debt was a $450 medical bill. I redirected every extra dollar — from cutting subscriptions to selling unused items — to pay it off in just three weeks. That small victory changed everything. For the first time, I felt in control. I celebrated by taking a long walk in the park — no spending, just gratitude. That moment of celebration wasn’t frivolous. It reinforced the behavior I wanted to repeat.

Does that mean the avalanche is wrong? No. For someone with strong discipline and a long-term focus, it’s often the better choice. But personal finance is personal. What works for one person may fail for another. The key is to pick a strategy that aligns with your temperament. If you thrive on quick wins, start small. If you’re motivated by saving money, attack the highest rate first. Either way, consistency matters more than perfection. The real power isn’t in the method — it’s in sticking with it.

Budgeting Without Deprivation: Making Room for Repayment

One of my biggest fears was that getting out of debt meant giving up everything I enjoyed. I imagined a life of instant noodles, no social outings, and constant sacrifice. But what I discovered was surprising: budgeting doesn’t have to mean deprivation. It means intention. Instead of cutting everything, I focused on adjusting habits — making smarter trade-offs that freed up cash without making me feel punished.

I started by tracking every dollar I spent for two weeks. I was shocked to see how much went toward small, automatic expenses: streaming services I barely used, a gym membership I hadn’t visited in months, and daily coffee runs that added up to over $120 a month. I canceled two subscriptions and switched to a cheaper phone plan, saving nearly $80 a month. I began meal planning on Sundays, buying groceries in bulk, and cooking at home more often. These weren’t extreme changes — they were simple, sustainable shifts.

I also embraced the idea of a flexible budget. Instead of rigid rules, I used a percentage-based approach: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This allowed me to still enjoy small pleasures — a movie night, a weekend picnic, a birthday gift — while staying on track. The key was awareness: when I spent on wants, I did it consciously, not impulsively. I even built in a “fun fund” of $25 a month — enough for a treat, but not enough to derail progress.

These changes didn’t feel like losses. They felt like reclaiming power. I wasn’t denying myself — I was redirecting my money toward what mattered most: freedom. Over six months, these small adjustments freed up over $300 a month for debt repayment. That extra cash became the fuel for my snowball method, accelerating my progress. Budgeting wasn’t the enemy — it was the tool that made repayment possible without burnout.

Building an Emergency Buffer — Even While in Debt

One of the most important lessons I learned — and one that’s often overlooked — is the need for an emergency fund, even when you’re deep in debt. For years, I believed I had to choose: pay off debt or save. But that’s a false choice. Without even a small buffer, any unexpected expense — a flat tire, a medical co-pay, a broken appliance — forces you back onto credit cards. And one setback can erase months of progress.

So, while I was aggressively paying down debt, I also started building a mini emergency fund. I began with just $20 a week — less than the cost of two dinners out. I kept it in a separate savings account, out of easy reach. Within three months, I had $250. It didn’t seem like much, but it was enough to cover a car repair without using my card. That small win proved something powerful: you don’t have to be debt-free to be safe. In fact, safety and repayment go hand in hand.

Experts often recommend a full emergency fund of three to six months’ expenses, but that can feel impossible when you’re already stretched thin. The truth is, you don’t need to go all the way at once. Start small. Aim for $500. Then $1,000. Protect that money like gold — only use it for true emergencies. As my buffer grew, my anxiety decreased. I slept better knowing I wasn’t one surprise away from disaster. That peace of mind was worth every dollar saved.

Over time, I increased my weekly transfer to $50, then $75. By the time I paid off my last debt, I had over $2,000 saved. That fund didn’t slow me down — it protected my progress. It also gave me the confidence to say no to new debt. When my washing machine broke, I paid cash. When my daughter needed new school supplies, I didn’t blink. That sense of security was a quiet victory — one that no credit card could ever provide.

Staying Motivated: Tracking Progress and Celebrating Small Wins

Debt repayment is a long game. There are no shortcuts, no instant results. Early on, I made the mistake of measuring success only by the total balance. When it dropped slowly, I felt discouraged. Then I shifted my focus: I started tracking progress in ways I could see and feel. I created a simple chart on my fridge, coloring in a bar each time I paid off a debt. Watching it fill up became a daily motivator.

I also scheduled monthly check-ins — just 30 minutes to review my budget, update my debt list, and adjust my plan. These sessions helped me stay accountable. I celebrated every milestone, no matter how small. When I paid off my first $1,000, I treated myself to a new book and a quiet afternoon in the garden. When I eliminated my second credit card, I took a day trip to a nearby town, packing a picnic and leaving my wallet at home. These rewards cost little but meant everything.

Motivation fades when progress feels invisible. But when you create visible markers — a chart, a jar of cash saved, a calendar of paid-off dates — you train your brain to see forward motion. I also found support in unexpected places: a quiet conversation with a trusted friend, a podcast about financial freedom, even a sticky note on my mirror that said, “You’ve come this far.”

There were setbacks, of course. One month, I overspent on groceries and had to borrow from my fun fund. Another time, I felt the pull to use my paid-off card for a “justified” purchase. I didn’t give in, but the temptation was real. What kept me going was remembering my why — not just the numbers, but the life I wanted. I wanted to sleep without worry. I wanted to say yes to my kids without calculating the cost. I wanted to feel strong, not scared. Those feelings were stronger than any impulse.

Life After Debt: How Paying Off Changed Everything

When I made my final debt payment, I didn’t throw a party. I sat quietly, looked at my bank account, and cried. It wasn’t just relief — it was transformation. For the first time in over a decade, I owed nothing. My monthly cash flow increased by over $700 — money that now goes toward savings, retirement, and future goals. But the financial change was only part of it. The emotional shift was deeper.

I make decisions from strength now, not fear. I shop with intention, not anxiety. I plan for vacations, home improvements, and my children’s education — not as distant dreams, but as real possibilities. I’ve started investing in a low-cost index fund, letting my money grow instead of shrink. I’ve built a full emergency fund and even begun a small college savings account. These aren’t acts of wealth — they’re acts of freedom.

Most importantly, I’ve changed my relationship with money. It’s no longer my enemy or my master. It’s a tool — one I use with care and confidence. I still budget. I still track spending. But now, it’s not out of desperation — it’s out of discipline. I’ve learned that financial freedom isn’t about having a certain amount in the bank. It’s about having choices. It’s about peace. It’s about knowing you can handle whatever comes.

This journey didn’t require perfection. It required persistence. It didn’t demand extreme sacrifice — just consistent effort. If you’re in debt today, know this: your past doesn’t define your future. You don’t need a raise, a miracle, or a perfect plan. You need one step. One decision. One honest look at your numbers. Start there. The rest will follow. Debt isn’t a life sentence — it’s a challenge you can overcome. And on the other side? A life of freedom you’ve earned, one payment at a time.