Why Home Insurance Isn’t Just a Safety Net—It’s Your Smartest Risk Move

You’ve probably thought of home insurance as just another monthly bill you’d rather skip. I get it—until a pipe burst in my basement and I realized how quickly “minor” disasters become major expenses. That’s when it hit me: home insurance isn’t about fear, it’s about control. It’s not just protecting walls and floors—it’s shielding your future. If you’re cutting corners here, you’re playing financial Russian roulette. Let’s talk about how the right coverage quietly becomes your strongest financial ally. Most families work hard to build stability, and a home is often the centerpiece of that effort. Yet, too many treat insurance as an afterthought, a line item to minimize. The truth is, skipping or skimping on proper coverage doesn’t save money—it transfers risk directly onto your shoulders, where one unexpected event can unravel years of financial progress. This isn’t about scare tactics; it’s about smart planning. The right policy doesn’t just respond to loss—it prevents long-term damage to your budget, credit, and peace of mind. Let’s break down why home insurance is one of the most strategic financial decisions a homeowner can make.

The Hidden Risks Lurking in Your Home (That You’re Probably Ignoring)

Every home, no matter how well maintained, carries risks that are easy to overlook—until they’re impossible to ignore. Many homeowners operate under the assumption that disaster means fire or burglary, dramatic but rare events. In reality, the most common and costly threats are far more subtle. A slow water leak behind a wall may go unnoticed for weeks, eventually leading to mold growth that compromises indoor air quality and structural integrity. Faulty electrical wiring, especially in older homes, can spark fires without warning. Even something as simple as a guest tripping on a loose floorboard can result in a liability claim that exceeds $50,000, depending on injuries and legal costs. These aren’t outliers—they are predictable, recurring risks that insurers see every day.

Weather-related damage is another silent threat. Hail can dent roofs and damage siding, leading to water infiltration that weakens support beams over time. Heavy snowfall adds weight that older roofs may not be designed to handle. Windstorms can loosen shingles or break tree limbs, sending debris through windows. And in coastal or flood-prone areas, even a modest storm surge can compromise foundations. The danger isn’t always the immediate impact but the long-term deterioration that follows. For example, a cracked foundation may allow water to seep in season after season, warping floors and inviting pests. These issues often start small, invisible during routine cleaning or maintenance, but compound into major repair bills that can reach tens of thousands of dollars.

Another overlooked risk is personal liability. Homeowners are responsible not just for the condition of their property but for the safety of anyone who enters it. A delivery person slipping on an icy sidewalk, a neighbor’s child injured on a backyard trampoline, or even a contractor hurt during a renovation—each scenario could lead to legal action. Standard home insurance includes liability coverage, but many policyholders don’t realize how high the stakes can be. Medical bills, legal fees, and court-ordered settlements can quickly exceed personal savings. Without adequate protection, families may be forced to liquidate assets or face wage garnishment. The point isn’t to live in fear, but to recognize that risk is not hypothetical—it’s built into homeownership. Treating insurance as a passive expense misses the active role it plays in managing these everyday dangers.

Perhaps the most insidious risk is complacency. Because disasters don’t happen every day, it’s easy to assume they won’t happen at all. This mindset leads to underinsurance, lapsed policies, or reliance on outdated coverage that no longer matches the home’s value or the family’s needs. The reality is that every home accumulates risk over time—aging systems, rising construction costs, and changing local conditions all increase exposure. Smart risk management means acknowledging that protection isn’t optional; it’s foundational. Just as you wouldn’t drive a car without insurance, you shouldn’t own a home without a policy that reflects its true value and vulnerabilities. The goal isn’t to eliminate risk—because that’s impossible—but to transfer the financial burden to a provider trained to handle it.

What Home Insurance Actually Covers—And Where It Falls Short

Understanding what home insurance does—and doesn’t—cover is essential for making informed financial decisions. A standard policy typically includes four key components: dwelling coverage, personal property protection, liability insurance, and additional living expenses. Dwelling coverage pays to repair or rebuild the home’s structure after a covered loss, such as fire, wind damage, or vandalism. Personal property coverage helps replace belongings like furniture, electronics, and clothing if they’re damaged or stolen. Liability protection covers legal and medical costs if someone is injured on your property and you’re found responsible. Additional living expenses, sometimes called loss of use coverage, pays for temporary housing, meals, and other costs if your home becomes uninhabitable during repairs.

However, the scope of coverage is not universal, and many homeowners are surprised to learn what’s excluded. Flood damage, for example, is not covered under standard policies, even if it results from heavy rain or a burst pipe that leads to basement flooding. Separate flood insurance, often available through government-backed programs, is required in high-risk areas and recommended even in moderate-risk zones. Similarly, earthquakes are excluded from most standard policies, requiring a separate endorsement or standalone policy in seismically active regions. Other common exclusions include damage from pests like termites, wear and tear, and damage caused by lack of maintenance. These gaps exist because insurers view such risks as preventable or gradual, rather than sudden and accidental—the core principle behind most home insurance claims.

Another frequent source of confusion is the difference between market value and replacement cost. Market value reflects what your home could sell for in the current real estate climate, influenced by location, demand, and economic trends. Replacement cost, however, is what it would take to rebuild your home from the ground up using similar materials and labor. These figures can differ significantly, especially in areas where construction costs have risen faster than home values. If your policy is based on market value rather than replacement cost, you may not have enough coverage to fully rebuild after a total loss. This mismatch is one of the most common reasons for underinsurance, leaving homeowners to cover the difference out of pocket—a gap that can exceed $100,000 or more depending on the home’s size and location.

Policy language also plays a critical role in determining what’s covered. Terms like “actual cash value” versus “replacement cost value” have major financial implications. Actual cash value accounts for depreciation, meaning you’ll receive less for older items like a five-year-old refrigerator or worn carpeting. Replacement cost value, while often more expensive in premiums, pays to replace the item with a new one of similar kind and quality, without deducting for age. Upgrading to replacement cost coverage for personal property can make a significant difference in recovery after a loss. Similarly, liability limits vary by policy—$100,000 may seem sufficient until a serious injury leads to $300,000 in medical bills. Raising liability coverage, often for a small additional premium, can provide crucial protection. The key is to read the policy carefully, ask questions, and understand the details before a claim is needed.

The Cost of Cutting Corners: Real Stories from Underinsured Homes

The consequences of underinsurance are not theoretical—they play out in real homes, with real financial devastation. Consider the case of a family in the Midwest whose kitchen caught fire due to an electrical fault in an old appliance. The fire was contained to one room, but smoke damage spread throughout the house. Their policy covered structural repairs and replacement of damaged belongings, but they soon discovered a critical gap: the insurance only reimbursed them for the actual cash value of their kitchen cabinets, which were 15 years old. When they wanted to upgrade to modern, energy-efficient models during reconstruction, the insurer refused to cover the difference. The family faced an unexpected $40,000 out-of-pocket cost to bring their kitchen up to current standards, a sum they hadn’t budgeted for and had to finance through high-interest loans.

In another case, a homeowner in New England rented out a basement apartment to a college student. One winter morning, a visiting friend slipped on an icy walkway that hadn’t been salted. The fall resulted in a broken hip, leading to surgery and months of physical therapy. The injured party sued the homeowner for negligence. Although the policy included liability coverage, the limit was only $100,000. Medical and legal expenses totaled $275,000, leaving the homeowner responsible for the remaining $175,000. The family had to sell investments and dip into retirement savings to settle the claim. This case highlights how liability limits, often overlooked during policy selection, can become a financial time bomb when underinsured.

A third example involves a coastal homeowner who assumed their standard policy covered water damage. After a severe storm caused flooding in their basement, they filed a claim—only to have it denied. The insurer explained that flood damage was explicitly excluded and that the homeowner had not purchased a separate flood policy, despite living in a designated flood zone. The family was left with $60,000 in repairs, including damaged HVAC systems, ruined drywall, and mold remediation. They later learned that federal flood insurance would have cost less than $700 per year, a fraction of the repair bill. This story underscores the danger of assuming coverage extends to all types of water damage, when in reality, distinctions between rain damage, sewer backup, and flooding are critical.

These cases share a common theme: small savings on premiums led to massive financial exposure. In each instance, the families believed they were protected, only to discover too late that their policies had limitations they didn’t understand. The lessons are clear. First, coverage limits must align with real-world replacement costs and potential liabilities. Second, exclusions must be reviewed and addressed with supplemental policies when necessary. Third, policyholders should never assume that “standard” means “complete.” Regular reviews, especially after major life events or home improvements, are essential. Insurance isn’t a set-it-and-forget-it expense; it’s a dynamic part of financial planning that must evolve with changing circumstances. The cost of cutting corners isn’t just a higher deductible—it’s the risk of losing financial stability in a single event.

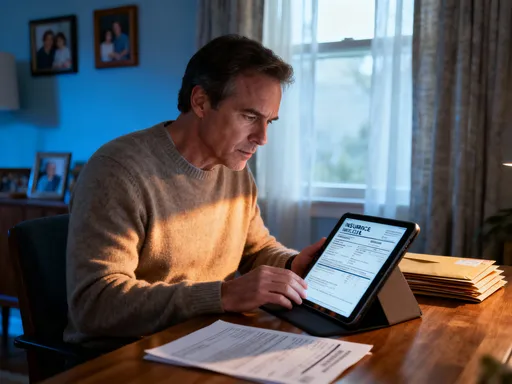

How to Audit Your Policy Like a Pro—Without the Jargon

Reviewing your home insurance policy doesn’t require a legal or financial degree, but it does require attention to detail. The first step is to obtain a full copy of your current policy, including the declarations page, which summarizes your coverage limits, deductibles, and premiums. This document is your financial roadmap. Start by checking the dwelling coverage amount and confirming whether it’s based on replacement cost or market value. If it’s the latter, contact your insurer to discuss upgrading to replacement cost coverage, which better reflects the true cost of rebuilding. Next, review personal property coverage, typically set at 50% to 70% of dwelling coverage. If you own valuable items like jewelry, art, or high-end electronics, consider scheduling them with a rider for full replacement value.

Liability coverage is another critical area to evaluate. While $100,000 was once standard, most financial advisors now recommend at least $300,000, with $500,000 or more for homeowners with significant assets. Umbrella policies, which provide an extra layer of liability protection, are affordable—often less than $200 per year for $1 million in additional coverage—and can be a wise investment. Check whether your policy includes medical payments to others, a feature that covers minor injury claims without requiring proof of fault, helping to avoid small disputes escalating into larger legal issues.

Pay close attention to exclusions and endorsements. Look for specific language around floods, earthquakes, sewer backup, and mold. If you live in an area prone to these risks, confirm whether you have added coverage. For example, a sump pump failure endorsement can protect against water damage from basement flooding, while a sewer backup rider covers cleanup and repairs if wastewater enters your home. These add-ons are relatively inexpensive but can prevent major losses. Also, verify whether your policy covers detached structures like garages or sheds, and ensure that any home-based business equipment is included, as standard policies often exclude business-related property.

Finally, conduct a household inventory. Walk through each room and document your belongings with photos, videos, and receipts. Store this inventory in a secure cloud account or external drive. Not only does this make filing a claim faster and more accurate, but it also helps determine if your current personal property limit is sufficient. Schedule an annual policy review, ideally before renewal, to adjust coverage for renovations, inflation, or lifestyle changes. Treating your insurance policy like a financial checkup—routine, proactive, and detail-oriented—ensures you’re not just insured, but properly insured.

Smart Upgrades That Lower Risk and Premiums

Home improvements aren’t just about comfort or resale value—they can also reduce insurance risk and lower premiums. Insurers reward homeowners who take proactive steps to prevent losses, offering discounts for safety and security upgrades. One of the most effective investments is a monitored security system. Homes with alarms are less likely to be targeted by burglars, and many insurers offer discounts of 5% to 20% for systems that include fire, carbon monoxide, and intrusion detection. A $200 to $500 upfront cost can lead to hundreds in annual savings, paying for itself in just a few years.

Water damage is the most common home insurance claim, making leak prevention a high-impact upgrade. Installing smart water sensors in basements, under sinks, and near water heaters can detect leaks early and send alerts to your phone. Some systems even shut off the main water supply automatically. These devices often qualify for a 5% to 10% discount and can prevent thousands in repair costs. Replacing old plumbing, especially polybutylene or galvanized pipes, further reduces risk and may improve your insurance rating.

Roof condition is another major factor. Storm-resistant roofing materials, such as Class 4 impact-resistant shingles, can withstand hail and high winds, reducing the likelihood of damage. Many insurers offer discounts for roofs that meet certain standards, especially in regions prone to severe weather. Upgrading electrical panels, particularly in older homes with outdated 60-amp or fuse-based systems, also improves safety and can lead to lower premiums. Modern 200-amp circuit breaker panels are less likely to cause fires and are viewed favorably by underwriters.

Other qualifying improvements include reinforced garage doors, which resist wind uplift in hurricanes, and updated heating systems that reduce the risk of carbon monoxide leaks. Even simple steps like clearing gutters, trimming trees, and installing storm shutters can demonstrate risk awareness to insurers. The key is to view these upgrades not just as home maintenance, but as strategic financial moves that reduce both risk and cost. Over time, the combination of discounts and avoided claims can result in significant savings, turning safety into a long-term financial advantage.

Navigating Claims Without the Headache

Filing a home insurance claim should be a straightforward process, but without preparation, it can become stressful and frustrating. The first step after any incident is documentation. Take photos and videos of the damage as soon as it’s safe to do so. Capture wide shots to show the overall impact and close-ups to highlight specific damage. Keep all receipts related to temporary repairs, such as boarding up windows or hiring a plumber to stop a leak. These costs are often reimbursable, but only with proper records.

Contact your insurer promptly. Most policies require timely reporting, and delays can complicate the process or even lead to claim denial. When speaking with a representative, be clear, factual, and concise. Avoid speculating about causes or admitting fault, especially in liability cases. The insurer will assign an adjuster to assess the damage, and it’s important to cooperate fully while also advocating for a fair evaluation. If you disagree with the assessment, you have the right to provide additional evidence, such as independent contractor estimates or expert inspections.

Communication is key. Keep a log of all calls, emails, and letters, noting dates, names, and what was discussed. This record can be invaluable if disputes arise. Be patient but persistent. Claims can take time, especially for extensive damage, but regular follow-ups help keep the process moving. If your home is uninhabitable, work with your insurer to arrange temporary housing under additional living expenses coverage. Keep all receipts for hotels, meals, and other necessary costs.

Avoid common mistakes like making permanent repairs before the adjuster visits, as this can prevent proper assessment. Similarly, don’t underreport damage to keep premiums low—this undermines the purpose of having insurance. If you’re unsure about the process, consider hiring a public adjuster, a licensed professional who works on your behalf for a fee, typically a percentage of the claim. While not always necessary, they can be helpful in complex cases. The goal is to ensure you receive the full benefits you’ve paid for, without unnecessary delays or denials.

Building a Long-Term Risk Strategy Beyond the Basics

Home insurance shouldn’t be viewed in isolation—it’s one component of a broader financial resilience strategy. The most effective approach integrates coverage with emergency savings, estate planning, and overall asset protection. For example, while insurance covers major losses, an emergency fund of three to six months of expenses provides a buffer for deductibles, temporary repairs, or income disruption during recovery. This combination ensures you’re not forced to rely on credit cards or loans when disaster strikes.

Estate planning also intersects with home insurance. If you own your home outright or have significant equity, ensuring your policy aligns with your will and trust documents helps protect your heirs from financial strain. A liability claim or unpaid repair costs could become their responsibility if not properly addressed. Naming beneficiaries and reviewing policies after major life events—marriage, divorce, the birth of a child, or retirement—ensures your coverage remains aligned with your current situation.

Changes in how you use your home also require policy updates. Converting a garage into a rental unit, starting a home-based business, or installing a swimming pool can increase liability exposure and may require additional coverage. Remote work setups with expensive equipment may need higher personal property limits. Even minor renovations, like finishing a basement, can increase your home’s replacement cost and necessitate a policy adjustment. Failing to update your insurer can result in underinsurance or claim denials.

The ultimate goal is to treat risk management as an ongoing practice, not a one-time decision. Just as you review your budget, investments, and retirement plans annually, your home insurance deserves the same attention. Work with a trusted agent, compare quotes every few years, and stay informed about local risks and coverage options. By taking a proactive, informed approach, you turn home insurance from a passive expense into an active tool for financial security. It’s not just about protecting your house—it’s about safeguarding your family’s future, one thoughtful decision at a time.